this post was submitted on 22 Sep 2024

1322 points (97.2% liked)

Political Memes

5520 readers

1385 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

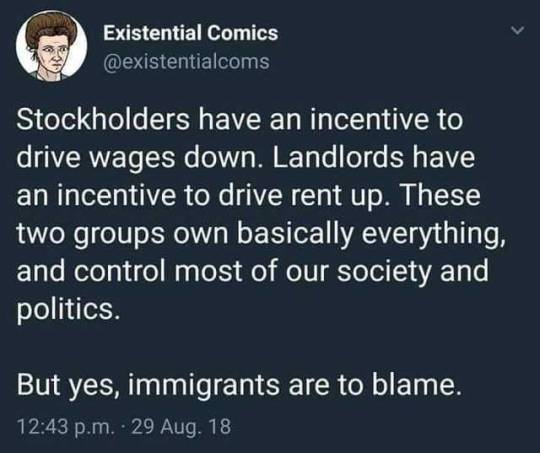

I am more in favor of tying wages to inflation.

It's a day broader metric.... That way, slave wage companies can't screw their workers by charging out the ass for the services they're providing for next-to-nothing. Then the business owners can fight with everyone about keeping the inflation rates low so they can enjoy paying their workers less.

Let these two asshole groups duke it out amongst themselves.

Inflation however is a load of bollocks. It's inaccurate to measure and can be oh so easily manipulated.

House prices have been rising at a stupid rate for decades yet we had in the UK a typical inflation rate of... 0.1% for a decade whilst house prices out performed everything else because they just ignore it.

Like how if your favourite brand of cereal goes up 700%, that won't be included in inflation data they make the assumption you'd eat a generic brand instead that only went up 0.5%

It's all bollocks the lot of it, remove money it's not worth anything anyway

You need to look at the rent for the cost of housing. That's what goes into inflation. House prices are high because inflation is low. Or more correctly, they are high because interest rates are low, which is because inflation is low.

Imagine you have a rock-solid investment opportunity. You are sure, it will generate a return of 10k until the next year. Say you can borrow money for 5%pa. If you borrow and invest 100k, you get 110k back and have to pay 105k back, for a profit of GBP 5k. But if everyone thinks the same, they are not just going to let you have free money. If they can't adjust the payout, they will adjust the price. So, at that rate of interest, the price has to be 200k for that 10k opportunity.

The point is that if rents are constant while interest rates go down, then the cost of buying must go up.

Remember if your yearly raise isn’t more than inflation, you’ve lost money.

Happened to me for a couple of years through COVID, where I got no raises for a few years and let's just say, I don't work at that company anymore.