Nuclear Energy

A community for nuclear energy enthusiasts.

Source: https://www.world-nuclear-news.org/Articles/Nukem-completes-mock-up-of-waste-cementation-syste

Germany's Nukem Technologies Engineering Services GmbH - a subsidiary of Russia's Atomstroyexport - announced that the experimental setup for its state-of-the-art in-barrel cementation facility has been successfully completed.

The company said that the cementation plants it developed can treat a wide range of radioactive wastes, including high saline vaporiser concentrates, radioactive ash from incineration plants, ion exchange resins, absorber and filter materials, radioactive sludges, as well as naturally occurring radioactive material (NORM) waste and hazardous waste from oil and gas production plants, refineries and chemical or medical industry.

During barrel cementation, liquid radioactive waste is enclosed in a 200-litre barrel. The end products are externally uncontaminated steel drums containing immobilised waste in a cement matrix. The system includes: the in-barrel mixer; all necessary drum handling systems such as grippers and roller conveyors; barrel transfer and capping/uncapping systems; dosing system for liquid additives and radioactive liquid waste; a camera system; a filling station for dry material; a tracking system; radioactivity monitoring; wipe test; a weighing system for the barrels; and an overflow sensor.

The entire process is designed to operate automatically, minimising the need for operator intervention. A unique QR code is generated for each barrel, containing important information about the waste and ensuring transparency and traceability throughout the entire process.

The hot cell where mixing operations take place features a high-density inflatable pneumatic seal system that prevents leaks during liquid waste pumping and dosing operations. Nukem Technologies said the in-barrel mixer with its four degrees of freedom ensures a completely homogeneous mixture and excellent product quality in terms of compressive strength and leaching rate for radionuclides in the final cement product.

The entire system, including the in-barrel mixer, roller conveyors and other components, is controlled remotely from a central control centre. The operating personnel have real-time insight into the ongoing processes and can react quickly to deviations.

"Before being used in nuclear facilities, machines and equipment for waste treatment are thoroughly tested in full-scale test facilities, so-called mock-ups," Nukem Technologies noted.

Announcing the completion of a mock-up of its in-barrel cementation system, the company said: "This milestone represents significant progress in the safe and efficient treatment of radioactive waste generated during the operation and dismantling of nuclear power plants and nuclear facilities."

"We have installed the system here to fully test the automated operation of the system and check each and every step and individual component," said Felix Langer, technology officer at Nuken Technologies.

He added: "The training of the staff in the mock-up facility allows the operator staff to start working efficiently, to know the system already in detail when it is installed. This speeds up installation and reduces errors during operation."

Source: https://www.world-nuclear-news.org/Articles/In-quotes-Great-British-Nuclear-s-Simon-Bowen-on

The key quotes from Great British Nuclear (GBN) chairman's World Nuclear News podcast interview covering future nuclear energy capacity in the UK.

The interview with GBN chairman Simon Bowen took place shortly after the UK government unveiled a roadmap to achieving 24GW of nuclear capacity by 2050, and as the six shortlisted companies (EDF, GE Hitachi, Holtec, NuScale, Rolls-Royce SMR and Westinghouse) await the next stage of the GBN-led selection process for the UK's small modular reactor programme. Here is an edited selection of key quotes:

How significant is the UK government's roadmap for GBN?

I think it's an overwhelmingly positive document, the next stage in the creation of the nuclear programme for the UK. It gives GBN three roles - it talks about GBN running the SMR selection process. It then talks about us taking on broader nuclear delivery, which means that if we do another gigawatt unit it is likely we'll run the selection process and then run the project and also, when advanced modular reactors (AMRs) come to fruition, it is highly likely that we would run that as well. The third role, which is really important, is that we advise government on the development of policy.

What about the Roadmap more generally?

The important thing is the reiteration of the target of up to 24GW with three to seven gigawatts every five years between 2030 and 2044, which I think is very important because it signals the range that we're aiming at. And then the reiteration that we are going to explore another gigawatt reactor after Sizewell, which for me is very, very important, because there is no way that we're going to get to 2050 and 24GW without the whole range and scales of reactors. Some big announcements on HALEU ... it also talks about the importance of regulation and skills and supply chains. Some people may say there's not a huge amount new in there - well there is, and there is the commitment of government to go on and deliver the programme. And it starts to spell out what the heart of that might be. It's a great step forward and a step in the right direction for forming the UK's new nuclear programme, which we will be accountable for delivering alongside our colleagues in Sizewell and Hinkley.

On siting and regulation:

The short-term focus of SMRs on the eight sites declared in the existing national policy statement is an important set of criteria that we are applying, but I think everybody recognises that if you're going to go after 24GW then those sites are simply not going to be enough, because we live on a small island and and we've got to have much more flexibility about the sites that we have access to. We have to allow the market to have access to the sites we are no longer looking at, or, the consultation is suggesting, that we should no longer be looking at the designation of sites, we should be looking at a criteria-based model which allows the developers to identify the sites and the usages they think they need, and then the criteria that they think should be applied, which should give an awful lot more flexibility to the market to deliver market-led projects. The second part is all about how you enable all of that and the whole role of planning, of environmental consenting, smarter regulation and the documentation - there's some really important consultation on those elements because if we don't get those more efficient, we will not be able to deliver on the target of 24GW. So a combination of more sites, simpler processes and more enabling regulation are really, really important.

On prospects of new sites for nuclear in the UK

We are looking at acquiring access to the existing sites for the SMR programme, sites like Oldbury, Wylfa, Heysham, Hartlepool and the others within the existing policy statement. Those are recognised nuclear sites which we can build on at scale - the SMR programme is all about scale and getting as quickly as we can to deliver on energy security and on the journey to net-zero. The views of the wider nuclear population are really important though, because when you look at AMRs, then if you get things like passive safety approved - walk-away safe - on a number of the AMR technologies, the sites that gives you access to is so much broader. And therefore things like the old industrial sites become more readily accessible because they will very likely be in a different regulatory regime, or modified regulatory regime, because the planning zones are going to be so much smaller. So a more flexible approach to allow the private sector to identify these sites where they know they've got the demand that will justify their business case, and a combination of that plus an enhanced regulatory regime, or a modified regulatory regime, for the different types of plants, all of that will start to open up more sites and therefore more output.

Will GBN be involved in the private-sector led initiatives?

When we did the scoping work for GBN, the very clear advice from all of the nuclear systems around the UK, around the world, was that you really do need a government programme, a government-led programme, an underwritten programme to rejuvenate the nuclear industry and get it started again. And that's exactly why GBN has been set up. What that doesn't do for one minute is preclude private developers developing their own projects, and we would want to encourage it. The only reason we haven't done that so far, is just bandwidth. Let's get set up on the journey to energy security and net-zero through the SMR programme, and now we're in a place where we want to really understand when developers tell us that they don't need any support from government, they don't need any money from the government, well tell us more about that, because we really want to understand it. Having market-led projects will absolutely allow the government to fulfill one of its aims, which is to get as much of this off the government balance sheet and out of the public finances as possible. So the sooner we can do that the better and therefore alternative routes to market and market-led projects are one of the major routes through which you'll deliver that. Our level of support would depend on the level of support they suggest - in the short term I think it is highly likely that we would be, as a very minimum, providing a supporting role.

On the current state of the SMR contest

I prefer to refer to it as a selection process because although they might be competing, we're selecting what we need. The first thing to say is that we're delighted that we got six highly credible technologies that have come forward and want to be part of our process, which is great. We are at the final stages now (11 January, 2024) of preparing and getting the approvals for the invitation to submit an initial tender document. This is the next stage where all six companies will engage with our contractual documentation in terms of how we think it should be structured. They'll submit the responses in their initial tender, we will then go through a process to down-select to around about four with the aim to be placing contracts later in the year. That process is ongoing, I think the main thing that we are very focused on is absolutely on pace, because we need to move quickly from an energy security point of view and from an international market point of view, but what I'm not prepared to do from the GBN board perspective, is trade pace for rigour. Because rigour in the procurement process can be very, very important. So we are in continual conversations at a board level to say, ‘right, ok, are we really ready to go, do we really have a good understanding of the documents, how they fit together’ because at a point where that's the case then we'll release them. I'm delighted about where we've got to, we've got a great team of people ... we’ve got the right people around the table in terms of the vendors and we have got a mass of stuff to do this year because once we've got the tenders out, we've then got to start pulling together what the development companies might look like.

On development companies

The tender is for the technology all the way through to completion of the regulatory process and final design and completion of design, with then the potential to place a contract. We need an entity that is going to develop the site, a development company, and because we're looking at hopefully more than one technology that we'll be developing, we will be highly likely to be having to pull together more than one development company who will characterise the site, apply for the the consent and the environmental permit, and the nuclear site licence, and then manage the construction and move into operation - and the scale of those is probably about the size of a FTSE 100 company, each one. So these are massive undertakings and we've got all of that to do. It is a hugely exciting time, but actually pretty daunting as well at the same time.

How many of the contenders are likely to be selected?

The initial down-select will be from six to around about four, depending on how things go, and then the documentation says between one and four will be awarded a contract. I think the optimum number is somewhere between two and three, but we will be retaining our optionality and there are some important conversations for us to have with government and the Treasury to determine what, in the policy space, they they are prepared to support.

Will each one chosen be tied to a specific site

At the point where we place the contracts, we will have identified and acquired access to the site. And we will match sites to technology and those sites will have the scale to be able to build multiple SMRs of that technology at that site. So the likelihood is it will be one, two or three in the first stage but then being very clear that if these are successful, as we hope they will be, and they can demonstrate that their costs are going to come down with the second, third and fourth units, and we can convince ourselves it's value for money, then we want to just continue building on those sites. As we've learned internationally, that is the right thing to do ... again subject to the final stages approval, our current view is that we will be placing contracts for more than one (reactor) because what we have to demonstrate is that modularisation works and therefore the investment that is required to build the modular factories.

Will Wylfa be available for SMRs?

I think there is a quite a big policy decision for us to make, which has not been yet made, which is, with the announcement that we are going to explore building another gigawatt scale plant after Sizewell, we've got to be clear about whether we are going to look to identify another site for that, or whether that site should be Wylfa. So there is a debate about whether Wylfa is used for SMRs or gigawatt. Therefore that will drive when we look to acquire access to it.

Is Final Investment Decision still targeted for 2029?

Yes, at the latest 2029. If we could do it before that, then, of course we will.

There's an election coming in the UK, will politics derail plans?

I am very confident that the UK political parties are committed to nuclear being a critical part of baseload power, because every nation that has nuclear capabilities worldwide thinks the same. And the COP28 declaration where 20+ countries have said we’ll triple nuclear by 2050 is massively important for us, so from a macro sense, I think we are in great shape. We've never been in better shape for nuclear, cross-party, I don't think that we will skip a beat in intent. Of course, when there is a change of party, then there is bound to be a little bit of a hiatus as the new team get their feet under the desk and determine how they want to apply their fiscal priorities. Therefore I think the risk is more of scale and pace than whether we do or don't have a nuclear programme. If I was asked to bet money on it I would say that we'll continue with the scale and the pace that we've set out so far, because actually there is no alternative.

General global outlook for nuclear

I think it mirrors what I've just said about the UK - that COP28 declaration was a very important moment in the international nuclear industry and it is one industry, you know, this is not a national industry where you can draw boundaries. Everything we do is international. Now what does that mean? Well, it's a good news/bad news story.The brilliant news is that we will, as an industry, have the opportunity to grow multiple technologies at multiple scales. And all learn from each other. Having moved out of the nuclear industry and come back into it, the thing I love about the industry is everybody wants to learn from everybody else. I've never seen an industry where people have the thirst for learning off each other and are prepared to share. It is almost unique in that sense, so the opportunity to learn and therefore all accelerate and therefore all contribute to combating climate change and net-zero is just hugely compelling and a great opportunity. So on one hand, I'm just very, very proud to be part of that because I think it's got huge potential. The bad side is there's a global demand for capability. And everywhere you look, we all want very similar skills, so although, the nuclear specialist skills are somewhere between 10 and 20% of what we need, the 70/80/90% of the skills we need are skills that can be employed in infrastructure, in carbon capture usage and storage, hydrogen and petrochem. It is a massive market that we're competing with and it’s a global market. So that's the challenge. It is hugely compelling and with massive opportunities, we have really got to get our act together in terms of skills and capability to understand how we're going to deliver on our ambitions globally, and critically, nationally.

What industry can do to help with nuclear's expansion plans

I think the first thing is we've got to act as one industry - unless we share skills and we find mechanisms for sharing skills across the nuclear sector, both in defence and civil and across the boundaries then it's going to be very, very difficult to succeed. I think the other thing is that the private sector, and I can say this because I'm still part of it, we have got as many signals as we need now to invest. We've got to get on with raising the cash to invest in the infrastructure and the skills and the capability that are required. So waiting for a starting gun any longer isn't going to work. That starting gun's been fired. And these announcements are part of that, so, I think we've all just got to trust in the fact that absolutely, this is going to happen, it's got to happen, and we need to be prepared with the right capability and the right capacity ... it's now up to us to deliver.

Source: https://www.world-nuclear-news.org/Articles/Major-module-installed-at-Xudabao-1

The largest and heaviest module - the CA20 - has been installed at unit 1 of the Xudabao nuclear power plant in China's Liaoning province, China National Nuclear Corporation (CNNC) subsidiary China Nuclear Industry 23 Construction Company Limited (CNI23) has announced.

The CA20 module - 20.6 metres long, 14.2 metres wide and 21 metres high and weighing just over 1000 tonnes - was hoisted into place on 24 January, CNI23 said.

The cuboid-shaped module will comprise of plant and equipment for used fuel storage, transmission, the heat exchanger and waste collection, among other things.

"The hoisting and placement of CA20 this time is another important milestone after the bottom head of unit 1 of Xudabao nuclear power plant was put in place, laying a solid foundation for the subsequent construction of the nuclear island," CNI23 said.

The construction of units 1 and 2 of the Xudabao (also known as Xudapu) plant was approved by China's State Council on 31 July last year.

On 6 November, the Ministry of Ecology and Environment announced that the National Nuclear Safety Administration had decided to issue a construction licence for Xudabao units 1 and 2, which will both feature 1250 MWe CAP1000 reactors - the Chinese version of the Westinghouse AP1000. A ceremony was held on 15 November at the Xudabao (also known as Xudapu) site near Xingcheng City, Huludao, to mark the start of construction of unit 1.

The Xudabao project was originally expected to comprise six CAP1000 reactors, with units 1 and 2 in the first phase. Site preparation began in November 2010. The National Development and Reform Commission gave its approval for the project in January 2011.

However, with a change in plans, construction of two Russian-supplied VVER-1200 reactors as Xudabao units 3 and 4 began in July 2021 and May 2022, respectively. These units are expected to be commissioned in 2027 and 2028.

The Xudabao plant is owned by Liaoning Nuclear Power Company Ltd, in which CNNC holds a 70% stake with Datang International Power Generation Co holding 20% and State Development and Investment Corporation owning 10%. The general contractor is China Nuclear Power Engineering Company Ltd, a subsidiary of CNNC.

US-based Zeno Power has selected Westinghouse Electric Company to process radioisotopes to fabricate its heat sources for its radioisotope power systems (RPSs). Zeno is working to bring its first commercial RPSs to market by 2026. Zeno’s work with Westinghouse will build upon its nuclear demonstration at the US Pacific Northwest National Laboratory in October 2023. The demonstration confirmed that Zeno's patented innovation increases the specific power (Wth/kg) of its Sr-90 heat source compared with historic Sr-90 heat sources.

Radioisotope power systems that convert heat into electricity for off-grid power have been used for space missions ranging from the Apollo moonshots to the Curiosity rover mission to Mars and the New Horizons mission to Pluto. Those systems have typically used plutonium-238, but Zeno is working on systems that make use of other radioisotopes such as strontium-90 (Sr-90), which is created as a byproduct in nuclear fission reactors. Existing strontium-based power systems tend to be bulky and Zeno’s more compact design could open the way for a wider range of applications.

"We’ve demonstrated the core building block of our technology – now we’re pleased to be working with the remarkable team at Westinghouse to enable and accelerate the deployment of our commercial RPSs,” said Harsh S Desai, Zeno Power Chief Commercialisation Officer.

Tyler Bernstein, Co-Founder & CEO of Zeno Power said working with Westinghouse, “we will build the nuclear hardware for our RPSs to provide reliable power in the most critical domains of the 21st century – from the depths of the oceans to the surface of the Moon”.

Dan Sumner, President of Westinghouse Operating Plant Services, said: “Our relationship with Zeno Power aligns with our vision to expand the use of nuclear into new markets.”

Source: https://www.world-nuclear-news.org/Articles/First-new-panel-in-a-decade-at-US-waste-facility

Work has started on mining a new panel at the US Department of Energy's (DOE) Waste Isolation Pilot Plant (WIPP). Panel 11 is the first of two waste emplacement panels approved last year by the New Mexico Environment Department as part of a 10-year extension of WIPP's operating permit.

Mined out of an ancient salt formation more than 2000 feet (610 metres) below ground, WIPP is the USA's only repository for the disposal of transuranic, or TRU, waste. Clothing, tools, rags, residues, debris, soil and other items contaminated with small amounts of plutonium and other man-made radioactive elements from the US military programme in sealed drums are placed in "rooms" within each panel.

A panel consists of seven rooms, each measuring 300 feet long by 33 feet wide by 14 feet high. It takes about two years to cut and outfit a panel, requiring the mining of around 120,000 tons of salt rock. A continuous miner cuts into the salt rock with a rotating drum, and can generate 10 tonnes of salt per minute which is either trucked for use elsewhere in the underground facility or hoisted to a salt tailings pile on the surface.

The natural movement of the salt rock that will eventually permanently encapsulate the waste also causes mined openings to close, so mining at WIPP is timed so that a panel is only ready when it is needed for waste emplacement. Waste is currently being emplaced in Panel 8, where the first room - Room 7 - has already been filled.

The creation of new panels allows safe and compliant emplacement of waste to continue, supporting environmental cleanup and national security missions, the DOE said.

Panel 11 is connected to WIPP's new air intake shaft, constructed as part of a major investment project to increase airflow, and to the rest of the underground facility by around half a mile (just under a kilometre) of new pathways.

Source: https://www.world-nuclear-news.org/Articles/Grossi-to-visit-Zaporizhzhia,-warns-against-compla

International Atomic Energy Agency Director General Rafael Mariano Grossi says he will visit Ukraine, Russia and the Zaporizhzhia nuclear power plant within the next two weeks, with one aim being to ascertain long-term plans for the plant, such as any proposal to restart units.

Grossi, briefing the United Nations Security Council for the sixth time on the situation in Ukraine, said he planned to visit the occupied plant and Kiev and Moscow within the next two weeks. It will enable him to assess the situation at the plant first-hand, eight months after his last visit.

He said: "Although the plant has not been shelled for a considerable time, significant military activities continue in the region and sometimes in the vicinity of the facility, with our staff reporting rockets flying overhead close to the plant, thereby putting at risk the physical integrity of the plant."

There were also continuing concerns about off-site power supplies. "There have now been eight occasions when the site lost all off-site power and had to rely on emergency diesel generators, the last line of defence against a nuclear accident, to provide essential cooling of the reactor and spent fuel," he said.

In a media briefing later he said the power supply loss might be the result of deliberate action, but it was often not possible to find the exact reason for the loss of power supply as it could be the result of something happening hundreds of kilometres away.

He said that during his visit he would be meeting the Russian operators to discuss more about the cooling water situation at the plant - wells have been dug since the destruction of the Kakhovka dam last year led to the decline of the previous water supply system. The IAEA also says that with the units not working, the cooling water temperature has dropped and ice has been seen in parts of the ponds.

Grossi added that during his talks there he would try to "ascertain their longer term plans for the plant - are they going to attempt to restart one or more reactors, and why and how - these are issues which have profound nuclear safety implications".

He warned against complacency, telling the UN: "A nuclear accident has not yet happened. This is true. But complacency could still lead us to tragedy. That should not happen. We must do everything in our power to minimise the risk that it does." Grossi added that the unpredictable nature of war meant you could not talk in terms of "a trend of things stabilising ... you can have a good week and then you have a blackout, you can have a good week and then a drone aims at the plant".

There had been times when the IAEA experts, a team of which has been at the plant since September 2022, "have not had timely access to some areas of the plant - sometimes for many months" and although no indications have been seen that the five core safety principles have been breached, "nevertheless, in line with the evolving situation, the agency needs to have timely access to all areas of the ZNPP of significance for nuclear safety and security" to monitor observance. The principles include the core ones that the facility should not be fired at, or from, or be used as a base for heavy military equipment.

There was continuing concern for the staffing levels at the plant, which has been under Russian military control since March 2022. More broadly, he said "we have put together a programme of health care assistance including through equipment and psychological support for all Ukrainian nuclear workers".

Source: https://www.world-nuclear-news.org/Articles/Advanced-nuclear-fuel-arrives-at-INL-for-testi

Westinghouse Electric Company has shipped 25 irradiated experimental nuclear fuel rods, including accident-tolerant fuel, to Idaho National Laboratory (INL) for testing and examination. The tests are part of the process to qualify the fuel for use in commercial reactors.

The shipment contains both accident tolerant fuel - also known as ATF - and high burnup fuel, which has been irradiated in the core of a commercial nuclear power plant. It is the first such shipment to arrive at INL for testing in two decades, the lab said.

Developed and manufactured by Westinghouse with technical assistance from several national laboratories, including INL, and supported by funding from the US Department of Energy (DOE), the new fuel technology is designed for extended use, enabling nuclear power plants to extend their operating cycle from the current 18 months to 24 months, reducing refuelling outages while delivering significant cost savings for customers and generating less spent nuclear fuel. The fuel will also increase a nuclear power plant's resilience under potential accident conditions.

These properties could be a "huge" economic benefit, said Daniel Wachs, national technical director of DOE's Advanced Fuels Campaign. The increased cycle length would eliminate one refuelling outage every 6 years and significantly increase electrical output. "The increased electrical output in the US could be the equivalent of adding new reactors to the fleet," he said.

Before it can be deployed for use in commercial reactors, researchers must examine and analyse how the technology performs under normal usage conditions, as well as carrying out additional experiments to understand how it performs under postulated accident conditions and to demonstrate behaviour during storage and recycling. This data will then be used to establish the safety bases required by the US Nuclear Regulatory Commission to qualify the fuel for use at US nuclear power plants.

"Continuous innovation is key to improving the nuclear sector's reliability, especially at a time when energy demand is increasing and nuclear is more vital than ever," said Tarik Choho, Westinghouse President of Nuclear Fuel. "Westinghouse is proud to join efforts with INL and other partners in the production and testing of these advanced nuclear fuels."

The fuel will be analysed and tested at INL's Materials and Fuels Complex, and will also be subjected to safety tests with simulations of power excursions or loss-of-cooling events in a controlled environment. These are designed to push the fuel to its breaking points and beyond, according to INL. The lab's Advanced Test Reactor is also being readied to accommodate fuels for endurance tests mimicking the wear and tear incurred over a decade of service in a commercial reactor in a fraction of the time.

"Receiving these fuel rods is a significant milestone for INL and the nuclear energy industry," INL Director John Wagner said. "As the nation's nuclear energy research and development centre, we possess the unique facilities, capabilities and expertise to perform this vital research.

"Completion of this shipment, along with the state of Idaho's reinstatement of the Department of Energy's ability to receive up to 400 kilograms of commercial spent nuclear fuel per year at INL for research and development purposes, send a strong message that we are once again open for business."

A shipment of irradiated nuclear fuel rods with this new technology has previously been delivered for testing to Oak Ridge National Laboratory in Tennessee. Research on the fuel will provide valuable data not only for US regulators and agencies but also for international partners and regulatory bodies. "The advanced testing and the post-irradiation examinations at both laboratories are key milestones to receive final approval from the Nuclear Regulatory Commission to deploy this innovative fuel to commercial reactors around the globe," Westinghouse said.

Source: https://www.neimagazine.com/news/newssteam-leak-discovered-at-japans-takahama-npp-11465290

A leak of steam from a pipe was discovered at unit 1 of Japan’s Takahama NPP in Fukui prefecture as well as increased amounts of leaking cooling water at another location. There were no radiation leaks, and nobody was injured and the plant reduced power output by 40% determine the causes, NHK reported, citing plant operator Kansai Electric Power Company. Steam was found leaking from the pipe that connects to a pump at the reactor. A worker carrying out inspections at the turbine building found the leak and stopped the pump which sends cooling water to power generation equipment. The Fukui prefectural government said there were no changes in the measurements at radiation monitoring posts in areas surrounding the plant.

Kansai Electric in November 2023 applied to the Nuclear Regulation Authority (NRA) to continue operating the 826 MWe pressurised water reactor after it reaches 50 years of operation in November 2024. Kansai Electric has submitted changes to the plant's safety regulations, including plans for the inspection and maintenance of the reactor for the next 10 years. Takahama 1, the oldest operating reactor in Japan, was commissioned in November 1974. In May, Japan enacted a law allowing power utilities to operate nuclear reactors for more than 60 years. The law will come into effect in June 2025.

Rosatom’s JSC Izotop in 2023 increased the annual export of isotope supplies by 15%. The was achieved through contracts with customers in Europe, Asia, the Middle East and the CIS, Izotop said. In particular, agreements with enterprises in China and India made it possible to increase revenue in these countries respectively by one and a half and three times.

At the same time, the geography of the supply of isotope products has expanded. After a break of many years, a batch of Russian sources based on cobalt-60 was delivered to Middle Eastern radiation centres. In addition, uninterrupted deliveries of the Macrotech technetium-99 generator to Belarus and Russian-made gallium-68 generator to Kazakhstan were ensured. Cooperation with Latin American countries also expanded. In 2023, a five-year contract was concluded with Brazil for the supply of medical products. And from January 2024, clinics of the Republic of Cuba have begun to receive the first regular deliveries of molybdenum-99 and iodine-131.

Izotop Director General Maxim Kushnarev said: “Developing cooperation with new partners and starting supplies of vital isotopes to these regions will increase the availability of specialized medical care and help save hundreds of thousands of lives.”

Source: https://www.neimagazine.com/news/newsdefective-seals-detected-at-olkiluoto-3-11465284

Finland's Teollisuuden Voima Oyj has said that inspections conducted in November and December 2023 have revealed defective seals in connectors used for level and pressure measurements. The inspections were conducted as a result of the seal defects detected in the spring. Defective seals were detected in seven of the eight inspected connectors, and in one connector the seal was missing completely. All the inspected connectors were fitted with new seals.

Connectors with defective seals are fully operable in normal conditions but they will not necessarily fulfil requirements specified for accident conditions. “Failure of these measurements in the event of a loss of cooling accident could hamper operator operations but would still not jeopardise the management of the accident. Situations in which the measurements now being processed would be needed are unlikely,” TVO noted.

In May 2023, a total of 108 connectors were inspected and missing seals were detected in 29 of them. All the inspected connectors have now been provided with new seals. The degree of severity of the event was rated at level 1 on the International Nuclear & Radiological Event Scale (INES). Although the basic rating of the event was 0, it was increased to 1, because deficiencies in procedures have contributed to the occurrence of a common cause failure.

OL3 began regular electricity production in April following the completion of trial operation. Construction of OL3 began in 2005 and various setbacks and delays mean the plant is some 14 years behind the original schedule and significantly over budget. OL3’s final price tag is put at some $11bn ($12bn), some three times what was initially estimated. OL3 attained first criticality in December 2021 and was connected to the grid on in March 2022. The 1600 MWe EPR was operated at full capacity for the first time in late September 2022. However, cracks were identified in the impellers of the feedwater pumps located in the turbine island, causing further delays.

Source: https://www.world-nuclear-news.org/Articles/In-pictures-Rooppur-2-passive-heat-removal-system

Open the source for the pictures.

Country’s nuclear share remains highest in world.

Belgium-based engineering company Tractebel and France’s Altrad Endel have signed a 10-year cooperation agreement to help France’s state-owned nuclear operator EDF carry out its long-term operation programme and to potentially provide nuclear services abroad.

The companies said in a joint statement that the agreement renews and reinforces their existing partnership.

Tractebel and Altrad Endel, an industrial maintenance and services company, have contributed for the past seven years to upgrading the French nuclear fleet, which provides more than 60% of France’s electricity generation, the highest proportion in the world.

President Emmanuel Macron announced plans in February 2022 for a “rebirth” of France’s nuclear industry with the possible construction of 14 EPR2 units and operating extensions for older nuclear plants from 40 years to 50 years or more.

EDF is aiming to begin preparatory works for a new EPR2 nuclear plant at the existing Penly nuclear site in northern France in mid-2024.

As part of EDF’s long-term operation programme Tractebel and Altrad Endel are already supporting EDF on the replacement of key components on some of its 56 reactor units.

“Tractebel and Altrad Endel have decided to extend their cooperation to better assist EDF with the major challenges of the fleet’s lifetime extension,” the statement said.

“The partners also intend to use the experience acquired in France to provide services abroad in the fields of civil engineering, mechanics, project management and construction for nuclear and energy projects,” it added.

Source: https://www.neimagazine.com/news/newskhnp-and-japans-ihi-to-co-operate-on-radwaste-disposal-11465275

Korea Hydro & Nuclear Power (KHNP) has signed a follow-up memorandum of understanding (MOU) with Japan's IHI Corporation (formerly Ishikawajima-Harima Heavy Industries) and the Hanwon Central Research Institute for joint cooperation on a low-level radioactive waste disposal project in Japan. KHNP noted that it had commercialised the world's first 'vitrification treatment technology' in 2009, which dramatically reduces the volume of low-level waste (LLW), lowering disposal costs and preventing external spills of radioactive material. The technology received a Korean patent in 2011. Based on the technology, KHNP signed an MOU with IHI in 2013 for the disposal of LLW from the Fukushima Daiichi NPP. Under the new MOU, the two companies "plan to pursue the expansion of low-level radioactive waste disposal business in Japan in earnest".

Source: https://www.world-nuclear-news.org/Articles/New-location-expresses-interest-in-hosting-UK-repo

A Geological Disposal Facility (GDF) Working Group has been formed in South Holderness, East Riding of Yorkshire, UK, to begin engagement about whether the area might be suitable for hosting an underground radioactive waste disposal facility. Three other communities are already involved in the GDF siting process.

"Establishing a GDF Working Group is simply the starting point for a conversation with a local community and is in no way an indication that a GDF will be built in a particular area," Nuclear Waste Services (NWS) said. "One of the Working Group's tasks will be to engage people across the community to begin to understand the local area and any issues or questions the community might have."

NWS will be a member of the South Holderness GDF Working Group, along with the independent Chair, David Richards, an independent facilitator, Invest East Yorkshire, East Riding of Yorkshire Council and members of the community.

The Working Group's role is to open up engagement with the community, begin the work to understand the local area and identify an initial search area for further consideration. The group will also identify initial members for a GDF Community Partnership, which would take over from the Working Group and be a more enduring vehicle for community engagement and involvement in the siting process, including developing a community vision and distributing community investment funding.

The Working Group will focus its initial engagement in the southern parts of Holderness. The first in a series of community engagement events will start in February.

"The South Holderness GDF Working Group marks the beginning of finding out more about what a GDF is and gives our community an opportunity to share their thoughts about what it means for them," said David Richards, independent Chair of the Working Group. "We want to work with local communities to discuss the potential of a GDF and the establishment of a Community Partnership, which if formed would benefit local good causes through grants of up to GBP1 million (USD1.3 million) per year."

"We are delighted to see the formation of the South Holderness GDF Working Group," said NWS CEO Corhyn Parr. "South Holderness joins three other communities involved in the GDF siting process who are already learning more about this vital project and the benefits and opportunities it could bring, such as the creation of thousands of jobs and opportunities for investment in local infrastructure."

Between late-2021 and mid-2022, four localities formed Community Partnerships interested in hosting a GDF - Allerdale, South Copeland and Mid Copeland in Cumbria in northwest England, and Theddlethorpe in Lincolnshire, in eastern England. However, in September last year, Allerdale was removed from the siting process due to limited suitable geology.

A GDF comprises a network of highly-engineered underground vaults and tunnels built to permanently dispose of higher activity radioactive waste so that no harmful levels of radiation ever reach the surface environment. Countries such as Finland, Sweden, France, Canada and the USA are also pursuing this option.

The UK search for a site is based on the idea of community consent. Finding the right site to build the GDF could take 10-15 years.

Oekraïne verwacht deze zomer of herfst te beginnen met de bouw van vier nieuwe kernreactoren. Dat heeft energieminister German Galushchenko bekendgemaakt. Het land probeert zo verloren energiecapaciteit als gevolg van de oorlog met Rusland te compenseren.

Op dit moment produceren drie kerncentrales in door Oekraïne gecontroleerd gebied meer dan 55 procent van de elektriciteitsbehoefte van het land. Kyiv wil de centrales uitbreiden om het verlies van Zaporizja, Europa’s grootste kerncentrale, te helpen compenseren. De vier nieuwe reactoren worden gebouwd bij de kerncentrale Chmelnytsky in het westen van Oekraïne.

Sinds de onafhankelijkheid van de Sovjet-Unie in 1991 heeft Oekraïne drie nieuwe kernreactoren gebouwd, in de kerncentrales van Zaporizja, Chmelnytsky en Rivne. Rusland kreeg de controle over de centrale in Zaporizja na de invasie begin 2022. De zes reactoren van Zaporizja zijn nu buiten werking.

Source: https://www.world-nuclear-news.org/Articles/Uranium-production-process-restarts-at-Langer-Hein

The first ore was fed to the Namibian mine's processing plant on 20 January, Paladin Energy has announced. The project to restart Langer Heinrich is now 93% complete, and commercial production is expected within the next few months.

The Western Australia-based company announced in June that it had decided to return the Langer Heinrich mine to production in the first quarter of this year. The project to restart the mine is now more than 93% complete with final construction and ongoing commissioning activities continuing across the processing plant, the company said. Initial ore feed has been sourced from existing stockpiles.

The company said it was still targeting first commercial production by the end of the current quarter - but "lower contractor productivity over the Christmas/New Year period" may push that date into early in the second quarter of the year.

"After more than six years of care and maintenance it is exceptionally pleasing to see production activities recommence at the Langer Heinrich Mine, with first ore feed to the processing plant achieved in January," Paladin CEO Ian Purdy said.

Total project capital costs are now expected to be USD125 million, up from the previous estimate of USD118 million, "with all major construction costs committed and including additional contractor resourcing forecast during the commissioning phase". The company executed a USD150 million syndicated debt facility on 24 January, and this will provide increased capital flexibility as production ramps up, Purdy said.

Operation of the mine had been suspended in 2018 due to low uranium prices.

Source: https://www.world-nuclear-news.org/Articles/Funding-to-support-UK-deployment-of-BWRX-300

GE Hitachi Nuclear Energy (GEH) has been awarded a GBP33.6 million (USD42.7 million) grant to support it in developing its BWRX-300 small modular reactor in the UK. The design will now enter the Generic Design Assessment (GDA) process.

GEH submitted its Future Nuclear Enabling Fund application with an experienced UK team including Jacobs, Laing O'Rourke and Cavendish Nuclear along with Synthos Green Energy, an investor and developer from Poland.

GEH said it is developing a UK supply chain which includes a memorandum of understanding with Sheffield Forgemasters for a potential supply agreement for UK-sourced steel forgings in support of the deployment of BWRX-300 small modular reactors (SMRs).

GEH's Future Nuclear Enabling Fund (FNEF) project includes a two-step GDA and Enterprise Readiness activities including an Advanced Manufacturing Plan and Operator Plan.

The Department for Energy Security & Net Zero (DESNZ) has now said the application "exceeded the quality thresholds across all four assessment criteria and successfully completed the department's due diligence and governance approvals processes".

In addition to awarding the grant, DESNZ has requested the Office for Nuclear Regulation (ONR), along with the Environment Agency and Natural Resources Wales, start a two-step GDA of the BWRX-300 reactor.

GDA is a process carried out by the ONR and the environmental regulators to assess the safety, security, and environmental protection aspects of a nuclear power plant design that is intended to be deployed in Great Britain. Successful completion of the GDA culminates in the issue of a Design Acceptance Confirmation from the ONR and a Statement of Design Acceptability from the Environment Agency. In May 2021, the GDA process was opened up to advanced nuclear technologies, including SMRs.

GEH will be supported in the GDA by Jacobs, which has supported applications for new nuclear power plant projects in the UK since 2007. In October, it was announced that GEH has reached the next stage of the Great British Nuclear SMR competition.

"We believe our BWRX-300 small modular reactor is an ideal solution for the UK's decarbonisation and energy security goals, and we appreciate the UK Government making this FNEF grant available to help demonstrate this," said GEH President and CEO Jay Wileman. "We have assembled a first-class team to deliver the BWRX-300 in the UK and this FNEF grant will help accelerate regulatory acceptance and its deployment readiness while we continue to develop a robust UK supply chain."

"The biggest expansion of nuclear power for 70 years is under way in the UK and small modular reactors are front and centre in this rapid revival," Minister for Nuclear Andrew Bowie said. "Today's GBP33.6 million in funding for GE Hitachi will help develop their design, putting us in an excellent position to become one of the first to deploy this game-changing tech."

The GBP120 million Future Nuclear Enabling Fund was launched by the UK government in May 2022 to support development of new nuclear energy projects, stimulate competition in the industry and unlock investment across the UK. The fund will help the government reach its ambitions for 24 GW of nuclear generating capacity by 2050.

In early December last year, Holtec International's UK subsidiary, Holtec Britain, was awarded a GBP30 million (USD37.7 million) Future Nuclear Enabling Fund grant for its SMR-300 design to complete Steps 1 and 2 of the GDA, as well as constructability and safety case assessments and completion of associated technical deliverables, including those of the safety, security and environmental cases.

Source: https://www.world-nuclear-news.org/Articles/Slovenia-s-PM-calls-summit,-seeks-nuclear-consensu

Prime Minister Robert Golob says Slovenia's long-term use of nuclear energy "requires the broadest national and political consensus" as he announces a meeting with senior figures including opposition party leaders and members of parliament from Hungary and Italy.

Slovenia has plans to build a new nuclear power plant - the JEK2 project - with up to 2400 MW capacity next to its existing nuclear power plant, Krško, a 696 MWe pressurised water reactor which generates about one-third of the country's electricity and which is co-owned by neighbouring Croatia.

A working group of Slovenian government ministers and industry officials was established in September with the aim of speeding up the implementation of the project and preparing "all the necessary bases for citizens to make high-quality and informed decisions" about it in a referendum which the government says is needed for the project to happen. Last week the country's main opposition party proposed an early consultative referendum on the project and the prospect of small modular reactors elsewhere in the country.

The planned timeline is for a final investment decision on JEK2 by 2028, with the aim of new capacity coming online in the 2030s.

On Wednesday, the prime minister's office announced the prime minister has invited the country's President, Natašo Pirc Musar, the National Assembly's President, Urško Klakočar Zupančič, as well as the presidents of the parliamentary parties and MPs from Italy and Hungary to a meeting about JEK2 where those attending "will address the question of how to set up the decision-making process on the construction of the second block of the nuclear power plant". According to Slovenia's STA news agency, the meeting will take place next Tuesday.

In October, GEN Energy CEO Dejan Paravan said there were three technology providers being considered for the project - Westinghouse, EDF and Korea Hydro & Nuclear Power - who all had strengths and "the decision will not be easy".

During a visit to the site by National Assembly members last week, Paravan said: "We are focused on accelerating the implementation of all preparations for the JEK2 project ... public support for the construction of the second unit of the nuclear power plant is growing. I see the reasons for this both in the energy crisis and the awareness of the need for self-sufficiency, as well as in discussions about decarbonisation and the green transition and the role of nuclear energy in this."

Uranium prices have hit their highest in more than 16 years.

Joint Venture partners Denison Mines and Orano Canada have announced plans to restart uranium mining operations at the McClean Lake mine in Canada.

Operations at McClean Lake, owned by the McClean Lake JV in which Orano is the operator and has a 77.5% stake, were suspended in 2008 in response to weak uranium prices.

The operations, set to begin in 2025, will use the JV’s patented surface access borehole resource extraction, or Sabre, mining method.

The property, about 750 km north of Saskatoon, consists of four mineral leases covering an area of 1,147 hectares and 13 mineral claims over an area of 3,111 hectares.

Uranium prices have hit their highest in more than 16 years in recent days after the world’s largest miner of the nuclear fuel, Kazakhstan’s Kazatomprom, highlighted production risks. The commodity’s bonanza is likely to continue prompting the restart of mothballed capacity.

Orano Canada president and chief executive officer Jim Corman said: “Our current ability to capitalise on the strengthening uranium and nuclear markets is the result of a long-term investment in R&D within Orano and the MLJV [McClean Lake JV] to secure continued activities at the McClean Lake operation well into the future.”

He said: “The groundwork we do over the course of 2024 is expected to put the MLJV in position to see Sabre in action and to commence production in 2025.”

The McClean Lake mill is expected to have sufficient capacity to process ore from the mine, while continuing with planned production from the Cigar Lake mine.

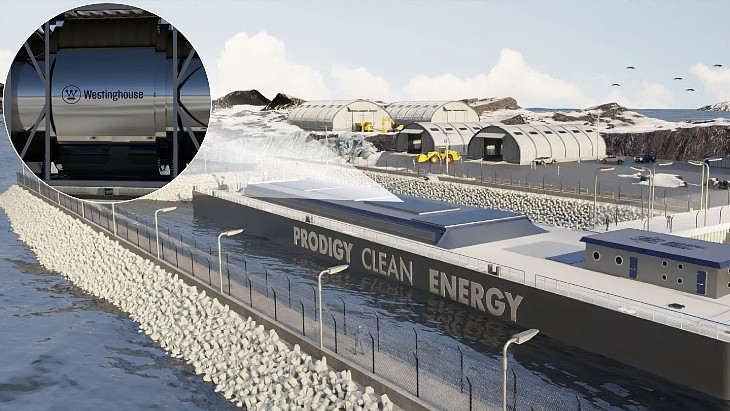

‘Plug and play’ micro-plant will be deliverable to ‘anywhere’.

US nuclear company Westinghouse is seeing significant interest in a project to build a transportable nuclear power plant that will provide “always-on” power in areas where the construction of nuclear projects would be traditionally considered economically or technically impractical.

Westinghouse and Prodigy Clean Energy, a Canadian developer of marine- and land-based transportable nuclear power plants, or TNPPs, are designing what they say is a solution for the constant demands for electricity and heat in these types of harsh, remote climates.

Their TNPP would have a 5-MW Westinghouse eVinci microreactor and would be prefabricated and transported to a site for installation at the shoreline or on land. The first unit could be operating by in Canada by 2030.

“From the start, our eVinci technology was designed to be transportable, that was a key design principle,” said Jon Ball, eVinci technologies president for Westinghouse.

“So, we designed it to be small, we made it plug-and-play, and we made it deliverable to anywhere. The TNPP from Prodigy brings an additional value to the inherent transportability of the technology.”

Westinghouse said in a blog post that the eVinci microreactor is the ideal technology to support the TNPP platform.

It uses heat pipes filled with liquid sodium to transfer heat from the reactor core to a power generation system. It requires no water in its operation, so no cooling pumps or other systems found in traditional light water reactors. It has few moving parts while operating, which it can do for eight-plus years without refuelling. Because of these attributes it is often referred to as a nuclear battery.

Westinghouse and Prodigy signed an agreement in 2022 and have completed milestones for conceptual engineering and regulatory studies.

Westinghouse said the next steps for the project include completing the TNPP design for the eVinci microreactor, completing development of a nuclear oversight model for TNPP manufacturing, outfitting and transport, and progressing licensing and site assessments to support a first project.

Source: https://www.world-nuclear-news.org/Articles/Nuclear-output-to-reach-new-record-by-2025,-says-I

Global nuclear power generation is forecast to grow by almost 3% annually on average through to 2026, reaching a new record high by 2025, according to the International Energy Agency (IEA). More than half of new reactors expected to become operational during the outlook period are in China and India.

According to the IEA's Electricity 2024, which provides forecasts for electricity demand, supply and CO2 emissions up to 2026, global electricity demand is expected to grow at a faster rate over the next three years as the clean energy transition gathers speed, with all the additional demand forecast to be covered by technologies that produce low-emissions electricity.

While global growth in electricity demand eased slightly to 2.2% in 2023 due to falling electricity consumption in advanced economies, it is projected to accelerate to an average of 3.4% from 2024 through to 2026. About 85% of the increase in the world's electricity demand through to 2026 is expected to come from outside advanced economies - most notably China, India and countries in Southeast Asia.

However, record-setting electricity generation from low-emission sources - including nuclear power - should reduce the role of fossil fuels in providing power for homes and businesses. Low-emission sources are expected to account for almost half of the world's electricity generation by 2026, up from a share of 39% in 2023.

By 2025, nuclear power generation is forecast to reach an all-time high globally - exceeding the previous record set in 2021 - as output from France climbs, several plants in Japan are restarted, and new reactors begin commercial operations in many markets, including in China, India, South Korea and Europe. The IEA expects global nuclear generation to be almost 10% higher in 2026 compared with 2023.

Between 2024 and 2026, an additional 29 GW of new nuclear capacity is expected to come online globally. Asia remains the main driver of growth in nuclear power, with the region's share of global nuclear generation forecast to reach 30% in 2026.

The IEA says the increase in electricity generation from renewables and nuclear "appears to be pushing the power sector's emissions into structural decline". Over the next three years, low-emissions generation is set to rise at twice the annual growth rate between 2018 and 2023. Global emissions from electricity generation are expected to decrease by 2.4% in 2024, followed by smaller declines in 2025 and 2026.

"The power sector currently produces more CO2 emissions than any other in the world economy, so it's encouraging that the rapid growth of renewables and a steady expansion of nuclear power are together on course to match all the increase in global electricity demand over the next three years," said IEA Executive Director Fatih Birol. "This is largely thanks to the huge momentum behind renewables, with ever cheaper solar leading the way, and support from the important comeback of nuclear power, whose generation is set to reach a historic high by 2025. While more progress is needed, and fast, these are very promising trends."

In its updated Net Zero Roadmap, released in September last year, the IEA revised upwards the role of nuclear power. In the updated net-zero emissions (NZE) scenario, nuclear generating capacity more than doubles to reach 916 GWe in 2050.

At the COP28 climate change conference that concluded in December 2023, more than 20 countries signed a joint declaration to triple nuclear power capacity by 2050. Globally, that would mean an addition of 740 GW of nuclear capacity to the current stock of 370 GW.

According to the IEA, achieving this goal will require tackling the key challenge of reducing construction and financing risks in the nuclear sector. It also notes that momentum is also growing behind small modular reactor (SMR) technology. While technology's development and deployment "remains modest and is not without its difficulties", R&D is starting to pick up, it said.

Source: https://www.world-nuclear-news.org/Articles/Westinghouse-and-Prodigy-collaborate-on-floating-n

The aim is for a first project in Canada by 2030 for a Prodigy marine-based transportable nuclear power plant (TNPP) featuring Westinghouse eVinci microreactors.

In a blog post, Westinghouse said the two companies had been collaborating since 2019 to evaluate deployment models for the eVinci microreactor. It said a "multinational corporation operating strategic critical minerals assets in Canada" had funded a study in 2019-2020 to identify reliable clean energy sources which led Prodigy to "pioneer the development of TNPP civil structures standardised for deployment at a wide range of sites".

The eVinci microreactor is described as a "small battery" for decentralised generation markets and for microgrids, such as remote communities, remote industrial mines and critical infrastructure. The nominal 5 MWe heat pipe reactor, which has a heat capability of 14 MWt, features a design that Westinghouse says provides competitive and resilient power as well as superior reliability with minimal maintenance. The Prodigy Microreactor Power Station can integrate a single or multiple eVinci microreactors, would be prefabricated and transported to a site for installation at the shoreline or on land.

The two companies signed an agreement in 2022, and with conceptual engineering and regulatory studies completed the next steps include "completing the TNPP design for the eVinci microreactor, completing development of a nuclear oversight model for TNPP manufacturing, outfitting and transport, and progressing licensing and site assessments to support a first project in Canada by 2030".

Jon Ball, eVinci Technologies President for Westinghouse, said: "From the start, our eVinci technology was designed to be transportable, that was a key design principle. So, we designed it to be small, we made it plug-and-play, and we made it deliverable to anywhere. The TNPP from Prodigy brings an additional value to the inherent transportability of the technology."

Mathias Trojer, president and CEO of Prodigy Clean Energy, said: "The eVinci microreactor’s compact design and simplified operating requirements make it optimal for integration into a Prodigy TNPP. Our technology will enable fleet deployment of the eVinci, accelerating the timeline to deliver clean, reliable and affordable power at commercial scale to remote regions."

As well as a microreactor power station, Prodigy is also developing a larger version, a small modular reactor (SMR) power plant, deployable at the shoreline "ideal for coal replacement and grid-scale power generation". In October 2022, it unveiled a conceptual design for an SMR Marine Power Station, developed with NuScale, which could house between one and twelve NuScale Power Modules.

Prodigy says that with both TNPPs it packages the microreactors or SMR into the prefabricated and relocatable power plant structures and transports them to their site, and removes them at the end of life after 60 years, so "simplify the full facility lifecycle, dramatically reducing new build costs and complexity".

Source: https://www.world-nuclear-news.org/Articles/Tender-launched-for-UAE-nuclear-fuel-plant

The UAE's Emirates Nuclear Energy Corporation (ENEC) announced it has launched a tender for a domestic nuclear fuel assembly fabrication facility. The facility will produce fuel assemblies for the Barakah nuclear power plant.

"Over the past 18 months, we have been conducting an extensive review into the needs of the UAE Peaceful Nuclear Energy Programme going forwards and specifically the strategic supply of the fuel assemblies needed to power the UAE's Barakah Nuclear Energy Plant over the next 60 years ahead," ENEC said. "As part of examining a range of options, we have entered into the tendering for a domestic fuel assembly fabrication facility."

It said the facility would be dedicated to the industrial fabrication of fuel assemblies from their various components.

"Although the fuel assembly facility will neither involve enrichment or reprocessing, the fabrication of fuel assemblies remains a regulated nuclear activity, given the need for stringent nuclear quality standards," ENEC noted.

The UAE embarked on its plan to implement a nuclear energy programme in 2008 when its government made the decision to build and operate a nuclear power plant to provide 25% of the country's electricity needs, diversifying its energy sources and supporting its long-term energy vision and net zero goals. Construction of the first unit began in 2012, and Barakah 1 was connected to the grid in 2020. The fourth and final unit at the plant is currently preparing to start up.

As part of its nuclear energy policy, the UAE made the decision to forgo domestic uranium enrichment and nuclear fuel reprocessing, two key elements of the country's commitment to non-proliferation.

To obtain nuclear fuel for the Barakah plant, ENEC conducted an extensive procurement competition with international nuclear fuel suppliers. Once the procurement process was complete, the company entered into contracts with six suppliers to provide materials and services, including: the purchase of natural uranium concentrate; the purchase of enriched uranium product and related products and services; and conversion and enrichment services.

Fuel assemblies are currently manufactured in South Korea by Kepco Nuclear Fuel - part of the prime contractor consortium led by Korea Electric Power Company - and then shipped to the UAE.

France’s state-owned project developer partly blames disruption caused by Covid pandemic and Brexit.

The UK’s flagship Hinkley Point C nuclear power station has been delayed until 2029 at the earliest, with the cost potentially increasing to as much as £46bn (€53bn) at today’s prices and developer EDF blaming Covid, Brexit and inflation.

Under French state-owned EDF’s latest scenario, one of the two planned units at Hinkley Point C, in Somerset, southwest England, could be operational in 2029, a two-year delay compared with the company’s previous estimate of 2027.

But it could be further delayed to 2031 in adverse conditions, EDF said. The company did not give an estimate for the second unit.

EDF, which is supplying two EPR units for the facility, said the cost would now be between £31bn-£35bn based on 2015 prices, depending on when Hinkley Point C was completed. The BBC said that in today’s prices, the cost could rise to as much as £46bn. The initial budget was £18bn, with a scheduled completion date of 2025.

Hinkley Point C had already been delayed by construction disruption during the Covid pandemic.

The revised estimates come after the government recently announced ambitions for what it called the biggest expansion in nuclear power for 70 years and committed an extra £1.3bn to support the construction of two EPR plants at Sizewell C in southeast England.

In a letter to staff, Stuart Crooks, the managing director of Hinkley Point C, said there were 7,000 substantial design changes required by British regulations that needed to be made to the site, with 35% more steel and 25% more concrete needed than originally planned.

The project has also faced severe delays because of supply chains being hit during the pandemic, as well as labour shortages.

“Going first to restart the nuclear construction industry in Britain after a 20-year pause has been hard,” Crooks wrote.

Inflation, Labour And Material Shortages

“Like other major infrastructure projects, we have found civil construction slower than we hoped and faced inflation, labour and material shortages, on top of Covid and Brexit disruption,” he added.

EDF also blamed the latest problems on the complexity of installing electromechanical systems and intricate piping.

Crooks pointed out, however, that UK bill payers will not be directly affected by those building and cost time overruns.

EDF agreed to shoulder the risk and pay the full cost of construction, including any increases. This was in return for an agreed electricity price – known as a strike price – that was substantially higher than the average price in 2015 and would only rise in line with inflation.

EDF said in a statement that over recent months, the Hinkley Point C project has achieved a series of big milestones including the lifting into place of the dome on Unit 1, the detailed design for the next phase of electromechanical work and delivery of 70% of the equipment to be installed on Unit 1. The company said the steam generators have been built and are ready for delivery and testing of the UK instrumentation and control system is underway.

EDF has experienced delays on recent parallel EPR projects at Finland’s Olkiluoto-3 and Flamanville-3 in France. Olkiluoto-3 began commercial operation in May 2023 while Flamanville-3 is not yet online.

Tom Greatrex, chief executive of the London-based Nuclear Industry Association, said the more nuclear stations we build the quicker and cheaper it will become. Instead of building one plant at a time with long gaps in between projects, a programmatic approach, as outlined in the government’s nuclear roadmap, is vital to ensure we build expertise, maintain workforce capability and increase efficiency.

“Hinkley Point C is the most significant green energy project ever in the UK and represents the revival of an industry after a generation of not building any new plants,” Greatrex said. “Hinkley Point C is an integral part of the UK’s route to energy security and decarbonisation, and will continue to provide firm, clean power and jobs well into the second half of this century and beyond.

“What is important now is that we act with pace and scale alongside other clean energy technologies as we shift towards a net zero future.”

Alison Downes of the campaign group Stop Sizewell C said: “The government should cancel Sizewell C instead of handing over scarce billions that could be used instead for renewables, energy efficiency or – in this general election year – schools and hospitals.”

Once Hinkley Point C is complete, it is expected to generate enough electricity to supply some six million homes, for the next 60 years.

Background: Falling Output, No New Plants

The share of nuclear energy in the UK’s electricity generation has fallen to around 15% from 27% in the 1990s as older plants have been decommissioned and no new plants have come online.

The output of the UK’s fleet of nine units was 37.3 TWh last year, 15% lower than the year before because of station closures and statutory outages.

Since 2000, the UK has seen permanent reactor shutdowns at Bradwell, Calder Hall, Hinkley Point A, Hinkley Point B, Hunterston, Oldbury, Sizewell, Chapelcross, Dungeness and Wylfa. The last unit to go offline was Hinkley Point B-1 in August 2022.

The government and EDF started a process last year to bring private equity investment into the planned Sizewell C project, with EDF saying a sustainable commercial model is needed for a final investment decision.

Earlier this month, EDF’s UK division EDF Energy said it is planning to extend the life of four nuclear power stations in the UK and invest £1.3bn in its nuclear fleet as it aims to maintain UK nuclear output at current levels until at least 2026.

The French energy company said it would make a decision on whether to extend the life of the four advanced gas-cooled reactor stations – Torness, Heysham A and B, and Hartlepool A – by the end of the year. This would require regulatory approval.

EDF Energy operates all of Britain’s five nuclear power stations that generate electricity. A further three are defuelling (Hunterston B, Hinkley Point B and Dungeness B), the first stage of decommissioning.