this post was submitted on 08 Jul 2024

665 points (97.0% liked)

2meirl4meirl

840 readers

1 users here now

Memes that are too meirl for /c/meirl.

Rules:

-

Respect the community. If you're not into self-deprecating/dark/suicidal humor then this place isn't for you. Kindly just block and move on. This is just how some of us cope.

-

Respect one another.

-

All titles must begin with 2meirl4meirl. This is for multiple reasons. One is just so you can be lazy with titles but another is so people who aren't into this kind of humor can avoid it.

-

Otherwise just the general no bigotry, no dickishness, no spam, no malice, etc stuff.

Sidebar will be updated when I feel like and considering I'm Sadboi extraordinaire we'll see when that will be.

founded 9 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

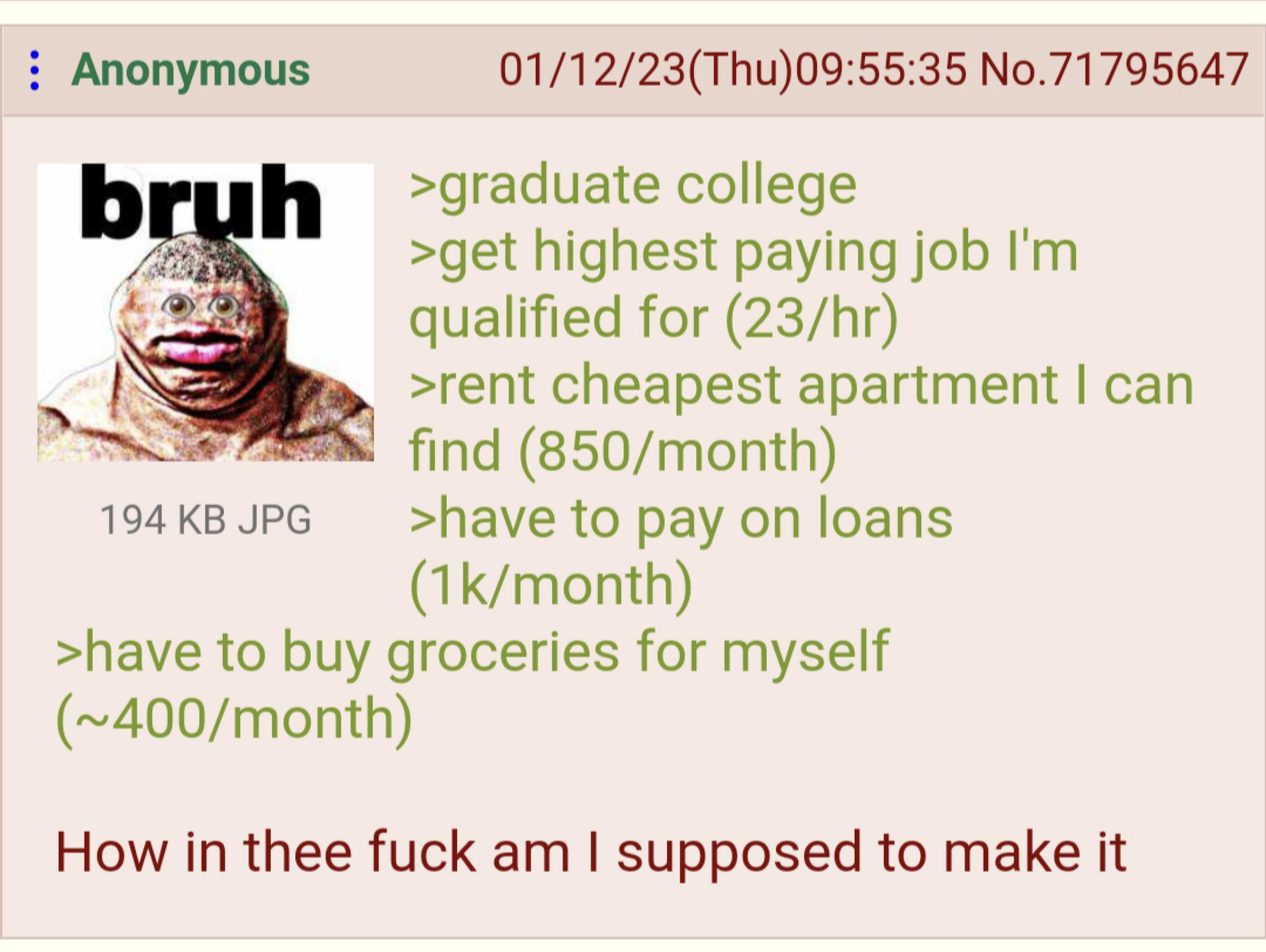

Expenses a normal person would likely have that aren’t mentioned:

Plus what lawless hellscape is 15% for taxes and withholdings? In Ontario you’re paying 20% for taxes alone at the absolute minimum. That’s not including CPP, EI, and anything else you have like benefits co-pay or union dues.

The country is probably America, and the state is likely a red one. And you're right about lawless hellscape. We have states that don't collect income tax, 9 of them as a matter of fact. But they still pay federal income tax, which is the lions share of taxes.

I'm not even in one of those states, and for the majority of my working life my withholding has been about 15%. But, I wish I could pay 5-10% more in taxes for some universal healthcare. My employer pays about $10,000 a year per head for our premiums, which is very kind of them because they don't have to pay 100% of the premiums. And that wonderful healthcare plan is a "zero deductible", but not like you're thinking. No, the plan pays absolutely none of your medical bills or visits or prescriptions until you hit your yearly out of pocket, which is $9,000 in network, double that for out of network. What percent of my income do you think $19,000-$27,000 is? I'll give you a hint, it's more than 10% haha.

Oh, the cherry on top... The only urgent care facilities in my area that are in network are owned by one hospital group. They stopped doing walk in visits. You have to schedule "urgent" care days in advance or go to one of their "standing emergency room" clinics that are minimum $1000. They invented a new, more expensive tier of urgency in between urgent and emergency. I think this is what they mean when they say capitalism breeds innovation.

Your comment is the biggest problem we have right now. There's no, just paying a little more on taxes to get free healthcare. It's estimated that currently it would be $3-4 trillion a year for universal healthcare. The total taxable income the US made was ~$4.4 trillion. 41.5% of that is individual taxes. If everyone paid 10% more that would only be $182B. You haven't even scratched the surface of the cost. Adding universal health care is far more complicated than just everyone paying a little more in taxes.

Somehow only almost every other first world nation has figured it out, must be that American exceptionalism preventing us from figuring it out.

Also, I think you misunderstood my increase statement. I don't mean a 10% increase of the federal taxes, I mean a 10% additional tax on total income which is about 10x that. Even using that figure, you're really telling me that it would take a 24% increase to pay for this, and I'd love to see your sources for that.

And, this is fun, even with your tax increase requirement numbers, $18,000-$27,000 is 24%-37.5% of the median household income in America. Turns out, even if it were as absurdly expensive as you say, it's literally a bargain for your average family. I now make more than the median, and it's only 20%-30% of my income, so still a bargain but not as good of one.

Are you saying that paying 30% of your income for free health care is a bargain? At the median income for 60 years would be almost $1.4MM.

After Taxes and Expenses having a negative net seems like a great time to file for a SAVE repayment plan on the loans, some rates as low as 0$ monthly.

Texas governments (city, state) makes money from sales and property taxes. The payroll taxes are federal.

Man, that sounds like the worst case, Ontario...

Attodaso man, fuckin attodaso.

OP didn't mention a car, unless they live in an area where it is somehow required, they might just go without one for now