this post was submitted on 27 Nov 2023

395 points (98.1% liked)

InsanePeopleFacebook

2660 readers

1 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

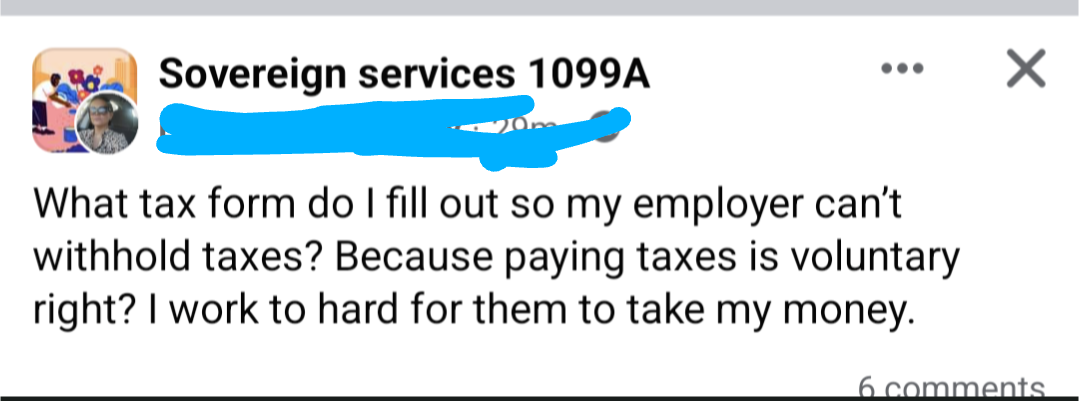

You write exempt in one of the boxes. They've hidden the part where it tells you which one. You can look it up, but its not stated clearly on the form anymore.

But you still have to pay taxes if you owe them, and you have to pay a penalty if they didn't withhold enough. But if you're poor enough you don't owe federal income taxes you can avoid giving the IRS an interest free loan if you file your form properly.

The US learned what happens if taxes are actually voluntary during the days of the articles of confederation. Results were predictable.

This is an actually useful answer for an otherwise crazy conversation. If you are poor, and have kids, you probably don't owe any money at the end of the year. Most poor people actually get money at the end of the year that they didn't even pay, from child tax credits, earned income credit, and the standard deductions. If you fall into that category then you are better off filing as exempt, so that you don't loan the government money interest free, just like you said. Those few extra bucks every week really matter when you're below the poverty line.

When we were poor, we looked at it as a sort of yearly savings account. We weren't so poor that we couldn't afford to have taxes taken out, so it worked out pretty well. Every time we got our refund check, we were able to do something like get the car fixed.

But you can save that money yourself, earn interest on it, and have access to it should you need it. I think it's the "have access to it" part that messes up most people. It's damned near impossible to save money when you're poor.

It's hard to save it when you have it in your pocket and interest is irrelevant if you spend it all within a year.

https://www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty

I was looking into this a few years ago and also wondered what if I tried to just pay my taxes at the end of the year. I get why it exists but you gotta love the double standard... wish I could could get interest and penalty pay on any money they owe me over 1k.

Same especially now with high yield accounts at 5%

This answer is correct, that form is called IRS W-4. All employers give this with setting up payroll.

The thing is, the IRS will still know how much you made and will be able to tell if those exemptions are authentic based on your tax return, so you'll still end up paying.

You could try to negotiate a 1099 contractor agreement sans the 1099 and pray the IRS never figures it out, but the company takes a risk with this too, bigger than the contractor, because they want to deduct your pay as an expense, and documentation is required.

Even better: work for a cash business and take your income in cash. Things might get a little spicy if you're depositing that much cash every month at your bank.

Just tell the bank you won it at rolling dice in the alleys or by day trading POGs at schoolyards.

tell the bank to mind its own business and keep all your deposits under the $10,000 reporting threshold but not in such a way that you are deliberately keeping it under that value so you're not guilty of structuring. But also banks tell the IRS your account values regardless because interest is taxable so you might be fucked regardless if the IRS cares. Just be rich and use loopholes, or be too poor to pay taxes, or pay.