this post was submitted on 13 Mar 2024

1514 points (97.9% liked)

Political Memes

5204 readers

2721 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

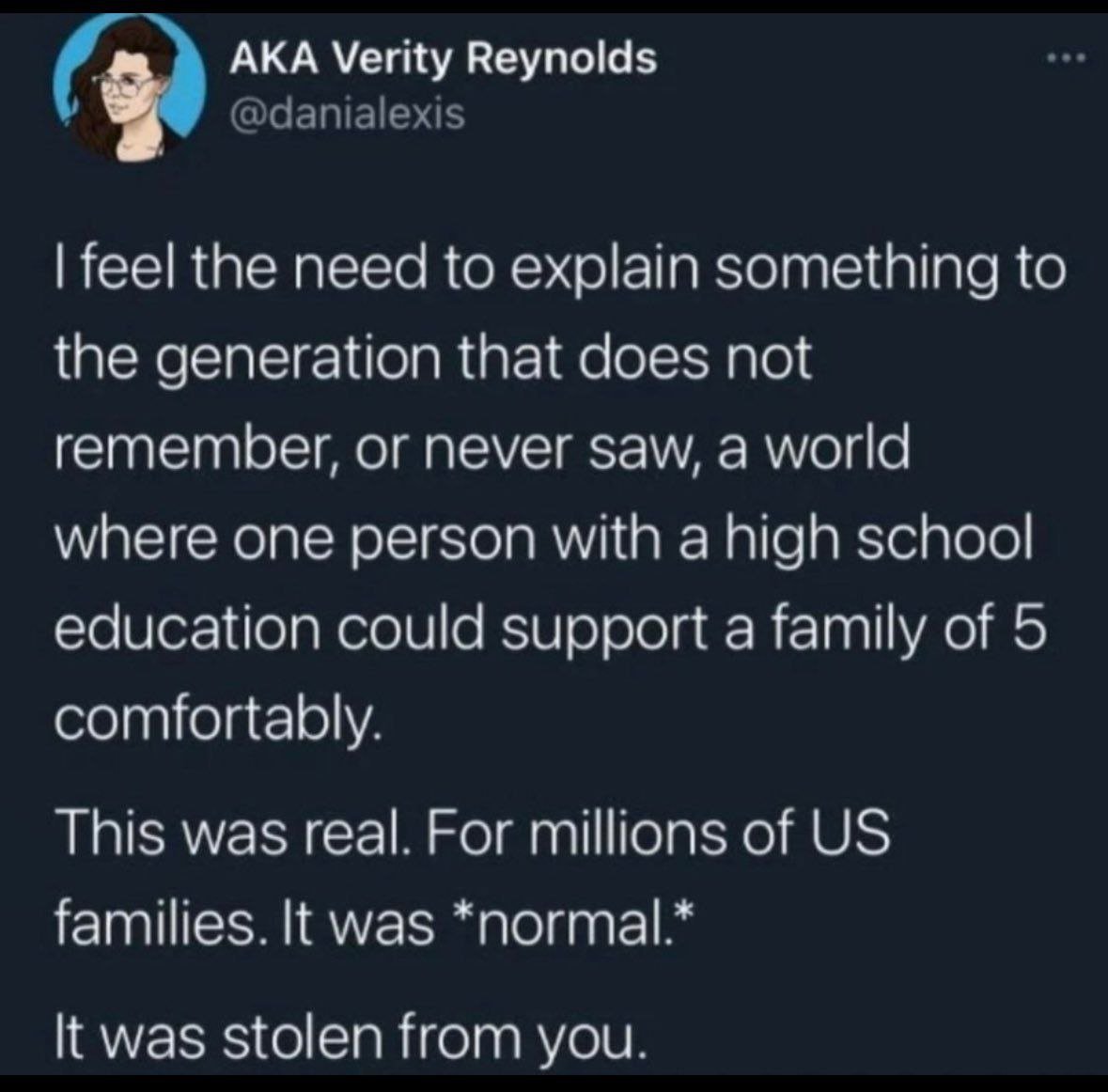

First and foremost you should mention the corporate tax cuts. How can corporations afford consolidation and other malicious shit they do? Their tax bill was cut in half. And their executive income tax rate was cut dramatically.

Rather than paying their employees, they give massive bonuses to their executives and save the rest for buying out competitors or attracting suitors.

It's not so much the corporate tax rate that did it, it's capital gains tax (and especially how it's implemented) that's the big problem.

The fact that capital gains isn't treated as regular income tax creates all sorts of really bad incentives. It means that executives are generally primarily paid in stock which means they are incentivized to push the value of that stock up. And since everyone making those decisions are also primarily paid in stock they'll authorize things like stock buybacks to boost their own personal wealth.

5 regulations I'd make to fix this problem.

No executives can be paid with equity.

The maximum salary can not be more than 10x the lowest salary in a company.

Tax capital gains as regular income.

Bring back the 90% top income tax bracket

Introduce a wealth tax. Perhaps 3% for a networth over 1 billion.

100 percent for every dollar over a billion, at least for individuals. No single person needs that much wealth.

Has the way capital gains tax works changed over the years?

Not really, it's mostly the rates that have changed. It used to be much higher.