this post was submitted on 30 Mar 2024

843 points (97.4% liked)

Memes

8015 readers

758 users here now

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), [email protected] can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. [email protected]

- Merkitse K18-sisältö tarpeen mukaan

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

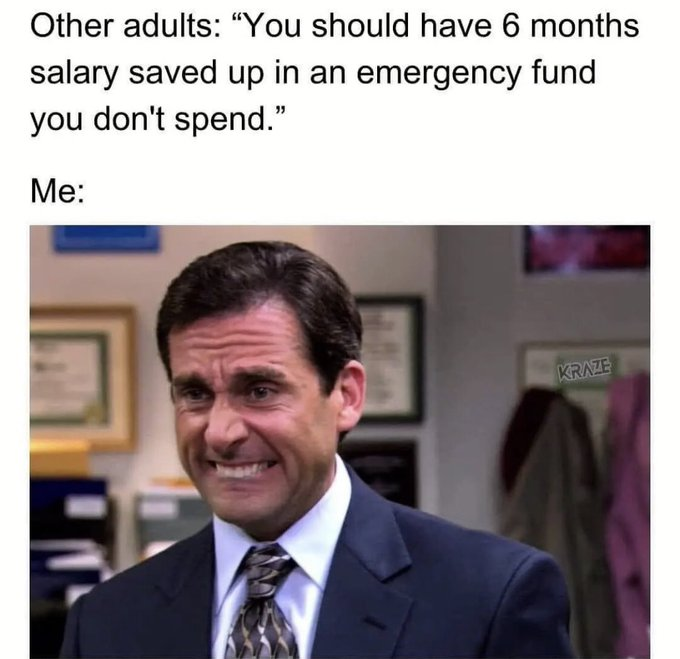

So if I want to accomplish this in a year I should be putting away half of every paycheck? Between rent, bills and groceries, who the fuck can afford that?

You can't accomplish it in a year.

Most people can't afford it in a year.

People who inherited a sizeable amount of money or are in the top 10% of earners are able to do so.

Yeah this is a 5+ year goal right?

I world say it’s getting to 3-months first, then paying down debt with high-interest rates, then trying for 6-months of expenses. Could easily take a decade, but the idea is that once you have that 6-months saved, it’s less likely that you’ll re-enter into high-interest debt in the first place.

Saving 3 months in an emergency fund while accruing high interest debt seems crazy to me.

Most people, especially those not very knowledgeable about personal finance, really should follow the Dave Ramsey baby steps.

How long is a piece of string?

Depends on how much you earn, what are your expenses, and how much you have saved already.

It's a however long it takes goal. I'm hoping to have it done in 2, although 3 and change is more realistic.

Unfortunately, if you can't afford to live with financial security, you can't afford to live. I haven't had an entertainment budget in over a year, and food has basically been what's on sale at the grocery store and maybe a gyro every month.

I wish you the best of luck. It isn't easy. Getting out of debt and having a fully funded emergency fund is a great feeling.

You don't have to. Start early, save aggressively, get it done before you worry about upgrading your lifestyle.

Also, maxing out the $23.5K of the 401K retirement account.

Easy, have a side hustle selling drugs and pay everything cash.

"Just start a small business."

That's what I keep hearing from Republicans.

I actually owned a small business, which is why I understand what bullshit advice that is.

Just stop eating and photosynthesize like the rest of us responsible adults

Psh look at this sun breather. I just de-evolved myself by my bootstraps and float near a hydrothermal vent like a real adult

People with less expenses, people with a higher salary, people who live in a less expensive area, etc, etc.

Most people don't accomplish 6 months emergency fund in 1 year, no. It's a marathon, not a sprint.

6 months of expenses, not income.

Most people can. I make $40k per year in a major city, and I'm getting there.

Considering rent or mortgages alone takes a vast percentage of many people's paychecks before you factor in things like student loan and medical debts, most people cannot.

And I have no idea how you can even live on $40k a year in a major city unless you're eating beans and rice with every meal and living in a studio apartment with 4 other people.

Median income here is in the mid $60's. I'm definitely poor, but I do save some money.

I live alone, and cook basically all my meals. Eating out and processed foods from a grocery store are both too pricey for more than once or twice a month. Mostly buy meat and fresh produce because carbs tend to give me stomach issues in large amounts.

Unfortunately, I am disabled. So while I have insurance, I cannot afford to see a specialist as regularly as I should. To be fair, this is out of network and like $700/month on top of my existing premiums and HSA contributions.

If nothing too crazy happens in the next year, I'll be able to change jobs and get my medical care back in network, meaning I don't need to ration doctor's visits for my disability. If nothing happens in 2 or 3, I'll have my emergency savings in a very good place. If nothing happens in 5, I might pay cash for my next car.

After that, fuck it. I'll be financially stable, I'll have another decade before I have a planned major expense like a car, and home ownership is a pipe dream here anyways. Last I looked, they start around $400k, which would mean coming up with about $180,000 for my down payment lol

Edit: Since you brought it up specifically, my rent and utilities is about $1200. I live in a very old building in a shitty neighborhood. The jail is right across the street, so there's enough of a police presence to keep it safe. It is clean, but my landlord is fucking terrible and I have to sue or threaten to sue to get anything fixed.

Sorry that you have to go through all of that. I'm dealing with a mystery illness right now which involves food, so I understand.

Joke's on you, i spend all my income

I make plenty of money and it took 15 years for me to get my emergency fund up to scratch.

Edit: of course, you can probably do it faster if you don't have any emergencies while funding the account lol.

It's supposed to be living expenses, not salary.