this post was submitted on 15 Apr 2024

719 points (98.1% liked)

Funny

6808 readers

342 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

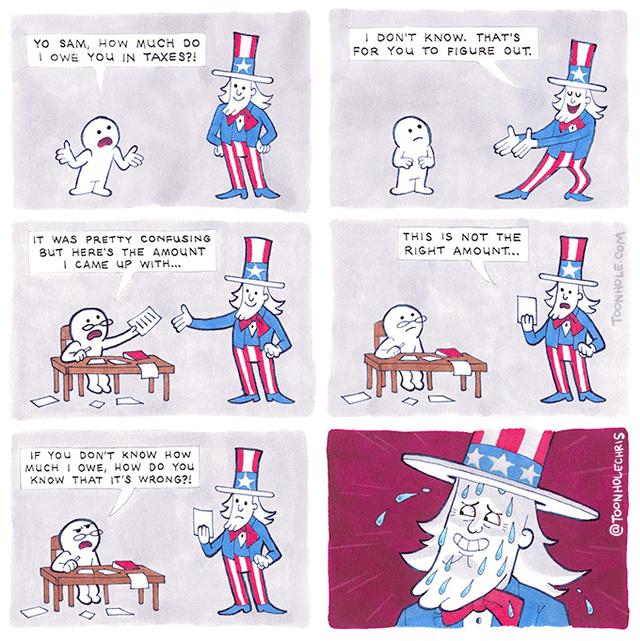

My son made a mistake on his state taxes and his return was rejected. The letter he got back basically said "we couldn't verify your reported property taxes, so you can resubmit a correction or do nothing and accept our version of your taxes" (where he gets back about $200 less because of a typo.)

So, like, yeah. They're just comparing your notes to theirs, with the default benefiting the state.

Seems like the property taxes would be the easiest thing in the world for them to verify. Unless they've been lying to themselves.

There's a lot. Every tax form you get is submitted to the government as well. W2,1095 a, 1099, property taxes etc. For most people, the government could just send a letter saying: we have all the documents. Do you want to itemize or take a standard deduction? Do you have anything else to report? Cool. The people that would still have complicated taxes would be the self employed.

Yes, it would be helpful if people didn't have to chase down a bunch of forms that were submitted to the IRS already. But for instance in our family there's a lot of medical expenses, well over the minimum for us to deduct them, so we'd still want to do that.

Yeah itemized deductions would still need to be offered, but for many people the work would be minimal since it usually makes sense to select the standard deduction. That's horrible that you even have to pay that much for medical expenses but that's a whole other conversation lol.

I believe they had a typo entering their PIN. The property number is like 15 digits long with multiple hyphens. It was fine last year, but this year they got "wE cAn'T vErIfY yOuR pRoPeRtY tAxeS" .🙄