this post was submitted on 26 Oct 2024

1556 points (98.6% liked)

People Twitter

5283 readers

557 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a tweet or similar

- No bullying or international politcs

- Be excellent to each other.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

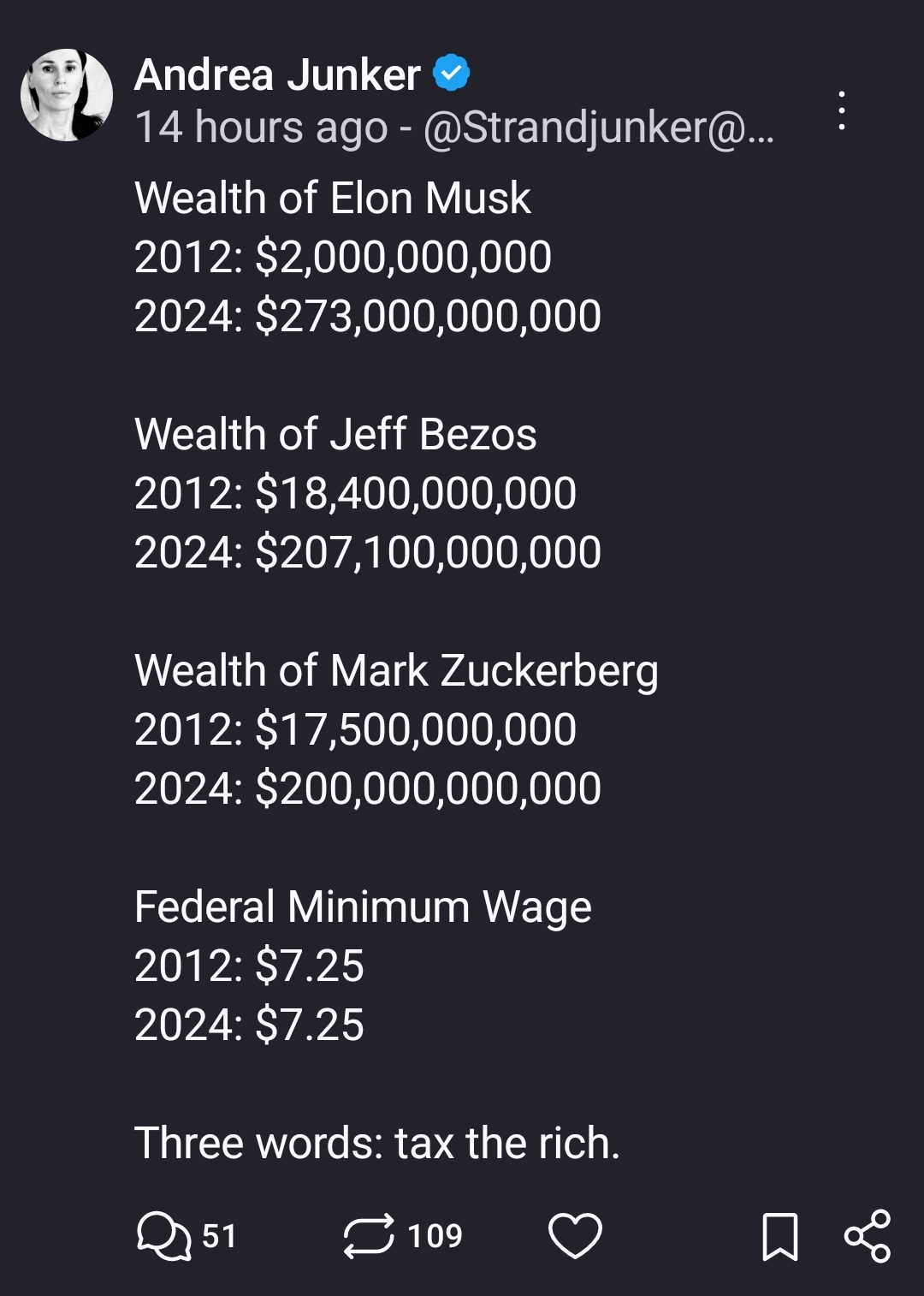

Maybe a hot take, but I actually think individual progressive taxes are great. Have a generous tax free threshold, but individual taxes stops excessive wealth hoarding and (in the case of inheritance tax) dynasties

I agree, and on inheritance anything over like $1m should be taxed heavily. Anything over say $10m or so should be taxed at or near 100%.

Inheritance tax is very good and fair. But a tricky problem is that if one place has a big inheritance tax, and another place doesn't - then rich people basically just put all their money in the place with no inheritance tax. ... We should do it anyway, but it does mean the bulk of that money probably won't get taxed.

Yeah, the race to the bottom is always an issue. It should still be done, but it needs to be considered.

It's just an extra step... Everyone gets a paycheck from a corporation of some kind... Instead of hundreds of millions to deal with, the IRS could just focus on the companies