this post was submitted on 30 Oct 2024

62 points (95.6% liked)

InsanePeopleFacebook

2700 readers

257 users here now

Screenshots of people being insane on Facebook. Please censor names/pics of end users in screenshots. Please follow the rules of lemmy.world

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

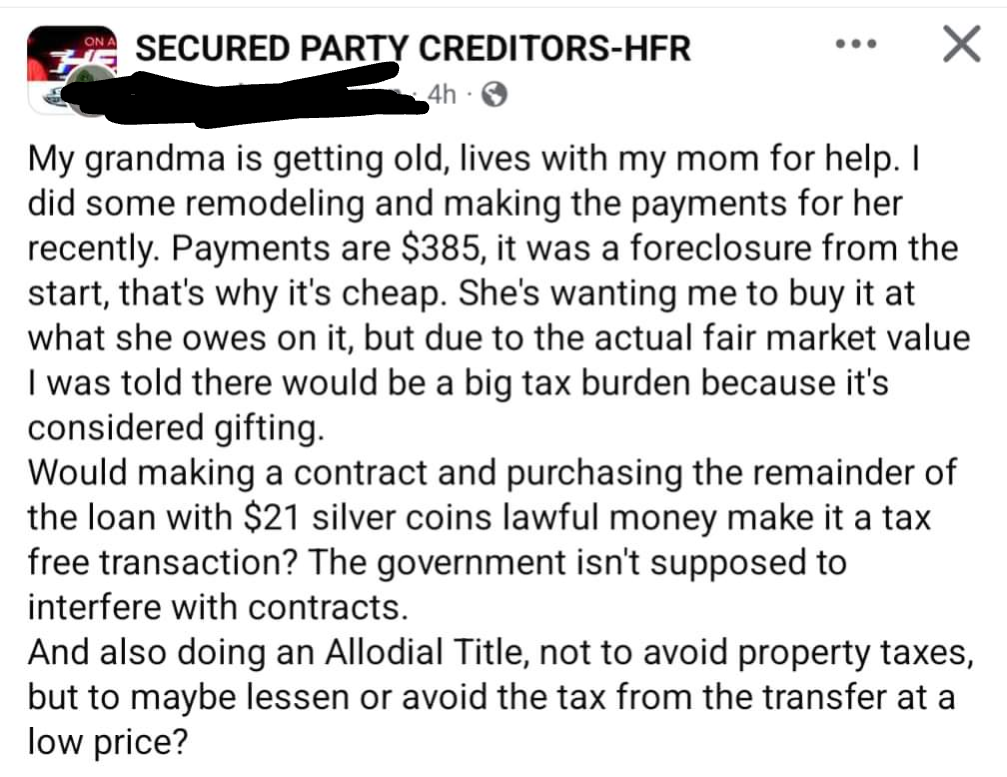

If I understand this person correctly, they're asking about how they can cheat their grandma?

Basically, grandma bought a house, hasn't paid off the loan, and the house is foreclosed. He wants to buy the house (maybe with his Grandma's blessing) for the remainder of the loan amount. Because the "value" of the house, as determined by the market, is much higher than the amount remaining in the loan, he would have to pay taxes for acquiring a "gift" amount of the difference.

It's complicated because it gets into wealth transfer laws, and how taxes work in a particular system.

On one hand, generational wealth is a real problem because it lets the rich get richer down their lineage especially for the ultra wealthy, but on the other, if my parents want to give me a house that they paid for and own, why should the government be able to demand some 20k in taxes for my inheritance?

The funny thing is, the gift wouldn't be taxed anyway. It's certainly valued less than the multi-million-dollar federal lifetime gift tax exemption (and no state has an exemption under 1 million, either)

There's a yearly limit for gifts at $18k in 2024.

True, but anything over that just counts toward estate tax, which has the aforementioned exemptions.

Then again, why should you have a house (or billions) and I not?

Your parents maybe worked for it, but you didn't. If your parents are rich, then you have probably had more help in life than someone with poor patents.

This is what I think is the correct way to deal with inheritance, good for you if you get a house btw!

Would that really be a gift? How does that work?

I'd bet generational wealth ain't what it's cracked up to be. Hows the saying go? "The first generation makes it, the second generation spends it, and the third generation blows it." Seen that quite a bit in my life experiences.

The only cases where generational wealth really comes into play are with truly wealthy families, and even then the house can come crumbling down. Wealth that can survive through several generations is quite rare.

If grandma don't know how to play the game, that's on her.