the_dunk_tank

It's the dunk tank.

This is where you come to post big-brained hot takes by chuds, libs, or even fellow leftists, and tear them to itty-bitty pieces with precision dunkstrikes.

Rule 1: All posts must include links to the subject matter, and no identifying information should be redacted.

Rule 2: If your source is a reactionary website, please use archive.is instead of linking directly.

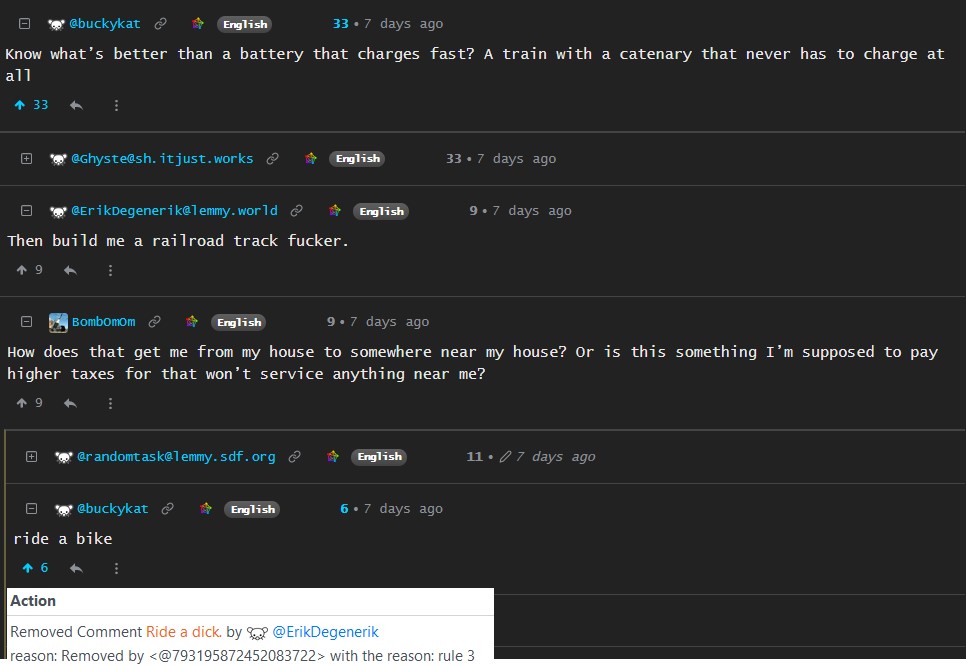

Rule 3: No sectarianism.

Rule 4: TERF/SWERFs Not Welcome

Rule 5: No ableism of any kind (that includes stuff like libt*rd)

Rule 6: Do not post fellow hexbears.

Rule 7: Do not individually target other instances' admins or moderators.

Rule 8: The subject of a post cannot be low hanging fruit, that is comments/posts made by a private person that have low amount of upvotes/likes/views. Comments/Posts made on other instances that are accessible from hexbear are an exception to this. Posts that do not meet this requirement can be posted to [email protected]

Rule 9: if you post ironic rage bait im going to make a personal visit to your house to make sure you never make this mistake again

view the rest of the comments

that failure of the federal government has nothing to do with what i was talking about.

on a local level the local taxes we all pay are directly in the budget for that spending. we literally vote on 0.025% property tax increases to pay for specific local projects.

"taxes do not fund government spending" is literally false for entities that don't control the currency or those resources.

Any tips on where I can learn more about this concept?

Modern Monetary Theory. From an purely economic perspective, SimulatedLiberalism is right.

Think of taxes as an olympic sized swimming pool, a politician may say they are raising taxes to dump a new bucket of water into the pool, but some guy comes around once a month to drain or fill the pool so it always stays level.