the_dunk_tank

It's the dunk tank.

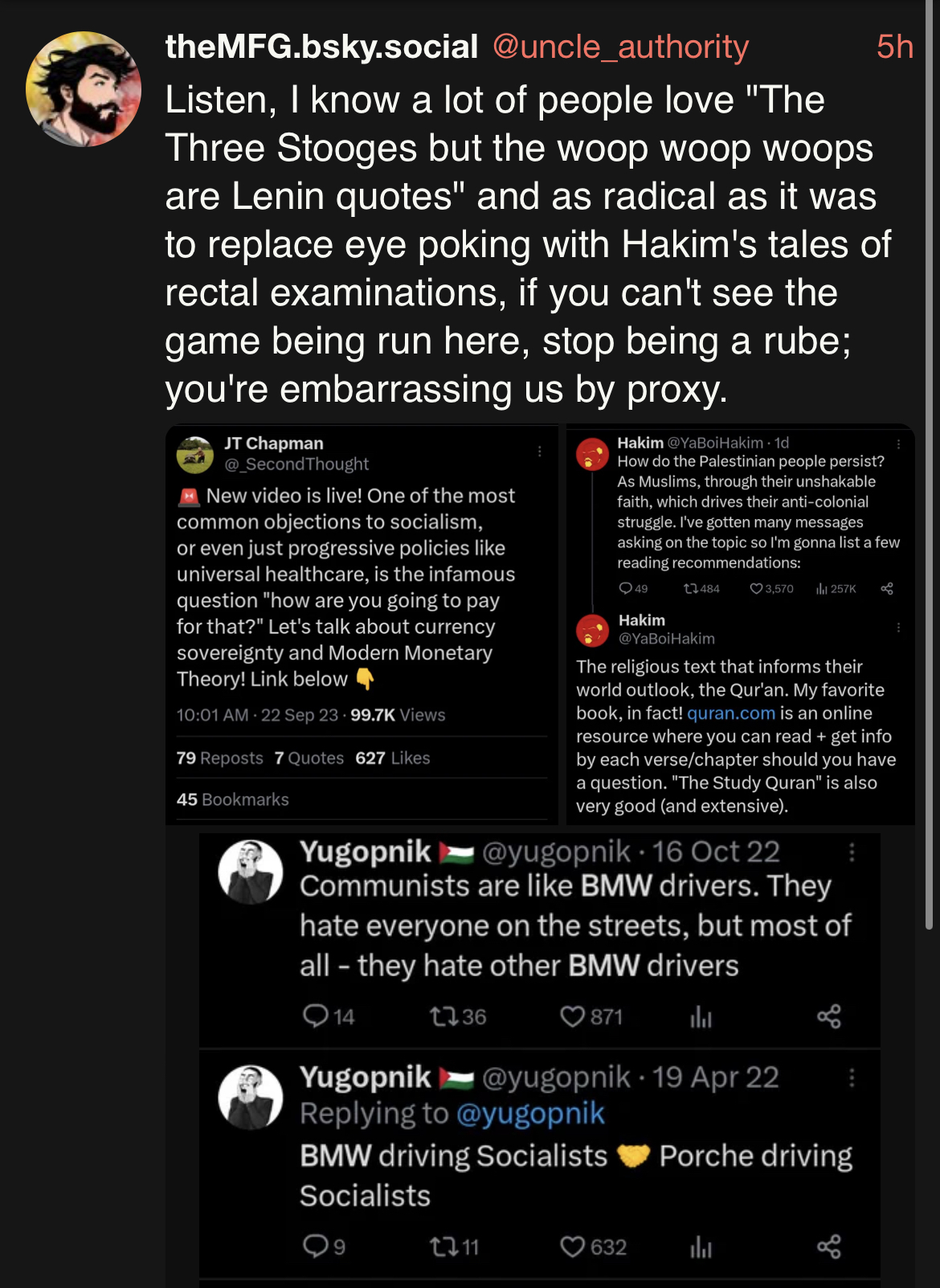

This is where you come to post big-brained hot takes by chuds, libs, or even fellow leftists, and tear them to itty-bitty pieces with precision dunkstrikes.

Rule 1: All posts must include links to the subject matter, and no identifying information should be redacted.

Rule 2: If your source is a reactionary website, please use archive.is instead of linking directly.

Rule 3: No sectarianism.

Rule 4: TERF/SWERFs Not Welcome

Rule 5: No ableism of any kind (that includes stuff like libt*rd)

Rule 6: Do not post fellow hexbears.

Rule 7: Do not individually target other instances' admins or moderators.

Rule 8: The subject of a post cannot be low hanging fruit, that is comments/posts made by a private person that have low amount of upvotes/likes/views. Comments/Posts made on other instances that are accessible from hexbear are an exception to this. Posts that do not meet this requirement can be posted to [email protected]

Rule 9: if you post ironic rage bait im going to make a personal visit to your house to make sure you never make this mistake again

view the rest of the comments

this is pretty deeply misleading. dollar demand from other countries (the petrodollar, china being developmentally chained to the us, etc) props up the exchange rate of the dollar and therefore also limits inflationary pressure on imports. the upshot is that fed can print money to cover fiscal deficits or stabilize the domestic economy w/ qe without worrying so much about inflation hurting americans because it's distributed across the entire world while the benefits are only realized here. there's only so much productive capacity to draw on and dollar hegemony allows the us to effectively shift its spending abroad and its concentration of wealth at home. e.g.:

some domestic owners of the dollar may see higher wages but the trillions of dollars of t-bonds and hard currency held by china, japan, latin america, and the arab world see only devaluation